Tax, Tax & More Tax

Yesterday was that day I part dread and part cherish each year, when my accountant visits with the magic number that is my Corporation Tax liability for the year gone.

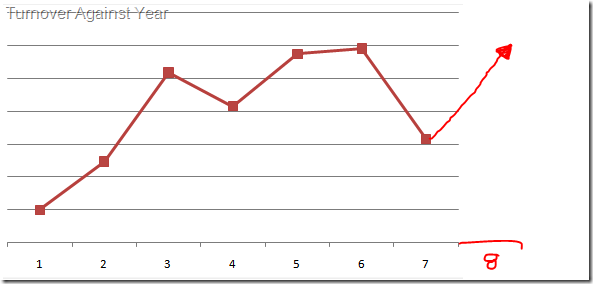

Yesterday it was the accounts for year 7 of Rockall Design ltd, which as I mentioned last year, was disappointing, to say the least.

Turnover in year 7 was about 60% of the year before. Luckily, this year is going much better and already - less than half way in to it - I've made as much as in the whole of the year before.

Brilliant. You must be rolling in money? Not quite.

The snowball effect of not putting aside enough tax in year 6 is still haunting me. Had year 7 been a better year I would have had enough to cover the tax of year 6. As it wasn't, I didn't and so I had to go cap-in-hand to HMRC who let me pay year 6's tax in instalments, which I've been doing during and with money earned in year 8!

You can see the problem here, I'm sure. Not having tax money put aside has a massive knock-on effect in the coming years.

Luckily the tax I owe on year 7 is, as you can imagine, much lower than year 6. As year 8 is going well I have the money to cover it put aside. While I've also got the money to cover the tax on money earned so far in year 8 and have put that aside in a separate account as well, it doesn't leave me with much to live on. Like, barely enough to survive.

The trouble with Corporation Tax is that you pay it all in one lump sum 9 months after your company's year has ended. My year ends on 31/10 and I pay tax on 31/July each year. The accountant tells me the amount to pay at about the midpoint of those two dates.

Part of me wishes I could move to a "PAYE" model for Corporation Tax. As it stands this year I'm having to put away 1,000s and 1,000s of Pounds in to a separate account, knowing it has to stay there untouched until August next year. No matter how rough things might get in the following 18 months, not touching the tax money you've set aside is so, so hard. I'd rather just give HMRC big lumps every now and then and not be able to touch it.

As it stands this year, my company's turnover doesn't seem to tally with my quality of life. I look rich but feel poor.

Running your own business is massively rewarding and I love every minute of it. Mostly. There are sides to it I could do without though. Mainly the stress. Over the last year or so it's been almost unbearable. Some might strive on it, but I don't like it much at all and can tell it's had a negative affect on general wellbeing.

The alternative to not running my own business is to get a "proper job". This would probably mean a lot of travelling, staying away and being tied to a desk 9-5 each day. I want to avoid that at all costs.

With my own company I love the variety of work I get, being at home all the time to see the kids, being around to help Karen out and being able to take impromptu time off. Stress is the price I have to expect to pay for this luxury, I guess.

Again, the lesson learnt is do not ever spend everything your company is earning. No matter how confident you are that you'll have enough spare in the following year to cover it. Anything could happen.

It's not a mistake I ever intend on making again.

Ending with a couple of clichés - every cloud has a silver lining and there's a light at the end of the tunnel.

It is interesting how you describe a 'proper job'.

I think nowadays it should be possible for you to get a proper job AND work mostly in your homeoffice at the times that fit your work-life balance. The world has become more colorful than it was in the last millennium :-)

Reply

You're probably right. But, I'd imagine that most jobs still expect the old-fashioned way of working and that ruling those out would make it harder to find work.

Hopefully, by the time I have to find a "proper" job things really will have changed ;-)

Reply

This rings a lot of bells with me. I'm also VAT registered so have to keep that aside for payment every 3 months.

Reply

Yeah, same here. Hence the "Tax, tax, tax" title to the blog entry. It feels like all I ever do is pay tax. If it's not tax on what Rockall earns it's tax on the money it pays me. Then the tax on just about every aspect of life. It's a wonder there's any left to pay any bills.

Reply

Show the rest of this thread

I had the same problem a couple of years ago - my one-man company was running very well (it's been about 7 years now) but my general well-being was low. I kept of worrying as to when the dip was coming (it never did) and although I ran my own company, it really ran me. I am now working a "normal" nine to five job and it better suits me.

Reply

Exactly right. I constantly worry about the future, when, if things continue as they are, I don't need to.

I like the "it ran me" bit. Spot on. Rockall ru(i?)ns my life ;-)

Reply

Must be a nightmare working for yourself. I work for a large corporation, my benefits and salary don't change and I should be a known quantity to the tax office, yet I've under-paid.

I've under-paid? Listen, tax office dickheads, it's not me declaring how much I should pay... you should work it out correctly rather than accusing me of being some shady character trying to avoid paying into the country's coffers. The only thing I want to avoid is nasty surprises which result in me being worse off. Tell you what, I'll head down to Rymans, buy a padded envelope, and I'll send you the shirt off my back - recorded delivery, at my own personal expense.

</furious but justified rant>

Reply

I understand your fury, but isn't this partly the fault of your employer rather than being completely the usual stupidity of the government body?

Reply

Like ursus, I traded the freedom you enjoy Jake for less stress and took a sizable cut in the process. Thankfully, budgeting has spared us any heart-attack moments. The more I learn, the more I think simple budgeting is the answer to less stress.

I recently wrote about municipal expenditures which are typically funded with several volatile income sources, much like self employment. Your chart fits nicely into the method I laid out for a balanced municipal budget - leveraging the power of projections.

http://fiducate.blogspot.com/2011/02/how-much-can-people-afford.html

Hopefully you don't have much debt but not to worry, a projection based budget helps you plot a mean income level that you can budget to (including debt repayment) with all excess going into your savings to pay future shortfalls. I know from experience that a lot of the stress of self employment is the paperwork and interactions with the tax mafia, but having a budget makes that so much more predictable and manageable.

Reply

Budgeting has always been "our" weakspot. It was mainly my fault for not being firmer with Karen and not misleading her in to thinking I was earning less than I actually was.

I'd say "I've just won a project worth X" and she'd say "Great, let's spend it on Y". I'd say "Yeah, go on then" hoping something else will come up to pay the tax. That something else always did come up. Until the fateful "year 6" that is.

Karen has felt my pain over the last year or so and she's just as keen to prevent the same thing happening again. To her credit she's been brilliant at helping get us through this. It's amazing how you can get the grocery bill down when you try.

Reply

It always pains me when the bright and creative are struggling to meet ends meet, it all seems so absurd and unfair, especially in light of the so many useless occupations that are taking in boat loads of cash.

Hang in there, Jake. You're brave to chose for this lifestyle and bearing the consequences. Now get that first iPhone app out and let Rockall rock again.

Reply

"many useless occupations that are taking in boat loads of cash"

Sounds like 90% of government departments here in the US. I have a novel, in which the main character had traveled from 1967 to 1767. She and her husband were at dinner and one of the patrons was complaining bitterly about the tax rate on landowners going up by 2%, from 3% to 5%.

Reply

How come we are not treated by the government as a customer? After all, you are sending money to them, which is how a customer would do it. What would that look like if we were?

IF you were a "customer" (I think that you are), when it comes time to pay your tax bill, you should include a letter that goes something like this:

Thank you for the tax bill. I really appreciate the services that you provided to me over the preceding 12 months (insert all that HRMC have done for you in detail).

Then, ask them what new services they plan to provide next year to keep your continuing support at its current level.

Finally, ask what "premium" services they have planned if you send them more money, which is your hope and desire.

Make sure to sign it:

Jake, Your favorite and loyal customer.

Reply

Ha! I like that. Wouldn't work in the States - we constantly struggle to remind our government that *they* work for *us*. As such, they are dutiful in their efforts to get everything they can out of their "employers". But the notion brings some interesting confusion to the private and public sector unions as they relate to government and tax payers... do they work for us or do we work for them? I guess if you have a government job, you technically work for everyone (public servant) while simultaneously, every private citizen works for you (unions tell gov't what they will accept in pay). This fine arrangement can certainly persist ad infinitum.

Reply

Jake, if it's any help at all, I have set up a primitve "liquidity" view in the notes database which follows my invoices. It helps out to see how much cash is really there, albeit very roughly. There are two documents, one the invoice documents, and the other an expense document. I average out the monthly costs like salary, rent, phone bills, ISP bills, etc, and that is 12 documents in the database. Then I have 4 VAT documents, one insurance document (bastards make you pay for a whole year upfront here in Switzerland), and one corporate tax document.

It was really quickly set up, and it helps me see where the money is (or isn't). Just looking at your current bank account balance works as a private person, but is completely misleading as a company.

If I could also recommend something, when the going gets better and the cash starts flowing in, start building up a nice little cushion. It has taken me three years but I now have 7 month's salary reserve cash sloshing in the company's coffers, and that makes life a lot easier - no poring over the accounts to see if there is enough cash next month.

Also, if you are just going to let your tax money untouched, then I would recommend talking to your bank manager and setting up fixed term deposits for that money - they give you a better interest rate, and since it is expensive to withdraw money "early", you have an extra incentive not to touch the money.

Reply

Here in Australia, businesses can pay tax along the way in a similar way to PAYG taxpayers. In fact, I recall from many years ago when I did have a company that we paid tax for your first year, the tax office pretty much wrote out to tell us to start making quarterly tax payments (which is a good idea anyway).

So, just move to Australia! Problem solved.

Reply